do nonprofits pay taxes in canada

See chapter 1 later. Tips you pay for any expenses in this.

You typically wont pay taxes on gifts received through international money transfers but youll need to report it using Form 3520.

. Accordingly instead of paying FICA payroll taxes they pay SECA taxesbasically they personally remit both the employer and employee side of the payroll tax for a total of 153 percent in Social Security and Medicare taxes. Charity Navigator the worlds largest and most-utilized independent nonprofit evaluator empowers donors of all sizes with free access to data tools and resources to guide philanthropic decision-making. Regular commuters from Canada or Mexico.

Business calls while on your business trip. This includes business communication by fax machine or other communication devices. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave.

If you have problems opening the pdf document or viewing pages download the latest version of Adobe Acrobat ReaderFor further information on tax treaties refer also to the Treasury Departments Tax Treaty Documents page. If you pay more than fair market value to a. The complete texts of the following tax treaty documents are available in Adobe PDF format.

QuickBooks Assisted Payroll monthly billing plan. Apply for an Employer ID Number EIN. You might have to pay taxes on transfers you receive if they were income including capital gains.

If you pay the premiums of a health or accident insurance plan through a cafeteria plan and you didnt include the amount of the premium as taxable income to you the premiums are considered. You may purchase copies of scanned Forms 990 990-EZ for IRC section 501c3 organizations Form 990-T IRC section 501c3 organizations filed after August 17 2006 and all 990-PF returns on DVD from the Ogden Submission Processing Center. We welcome your comments about this publication and suggestions for future editions.

American Family News formerly One News Now offers news on current events from an evangelical Christian perspective. Or in cash or by check or money order. You can use Form 1040-NR to figure the tax.

Because January 1 2022 is a nonbusiness day payments made on January 3 2022 will be considered timely. Dish Network Refreshes Its Set-Top Game with Google-Powered Hopper Plus By Daniel Frankel published 8 September 22. File Your Taxes for Free.

To deduct your contribution to a Canadian charity you must generally have income from sources in Canada. Open-sourced Reference Design Kit jointly developed by Comcast Charter and Liberty continues to proliferate into pay TV set-tops and broadband gateways NextTV. If they have a parsonage or housing allowance their SECA taxes are paid on a base that includes the value of that.

If you do not pay the tax. If the recipient is a US. There are many otherssee below Five are personal physical abuse verbal abuse sexual abuse physical neglect and emotional neglect.

I pay income taxes to my home country. Paying electronically is quick easy and faster than mailing in a check or money order. Dry cleaning and laundry.

NW IR-6526 Washington DC 20224. Faster ways to file your return. A court can sometimes act in the interest of justice and fairness to require one side to pay the attorneys fees.

Our experienced journalists want to glorify God in what we do. Citizen or lawful permanent resident green card holder who is a resident of Canada the benefits are taxable only in Canada. If you use an accrual method you generally report income when you earn it rather than when you receive it and you deduct your expenses when you incur them rather than when you pay them.

In other words if you give each of your children 11000 in 2002-2005 12000 in 2006-2008 13000 in 2009-2012 and 14000 on or after January 1 2013 the annual exclusion applies to each gift. The employer is liable to pay the deferred taxes to the IRS and must do so before January 1 2022 to avoid interest penalties and additions to tax on those amounts. Enter the tax on Form 4868.

You can pay your taxes by making electronic payments online. Courts have significant discretion when it comes to the awarding of attorneys fees and while judges do not generally like departing from the American Rule they might require a losing side to pay the others attorneys fees in certain limited situations. Viewing returns and determination letters on IRSgov.

As a cash basis taxpayer you generally deduct your rental expenses in the year you pay them. Pricing includes 1 state. DVD and paper copies.

Chicago police looking for officer impersonator with badge gun If you see a person in police uniform call 9-1-1 and report their car and license plate information. When you prepare your federal tax return the IRS allows you to deduct the donations you make to churches. You can make this election at the same time you file your taxes by filing Form 1120S attaching Form 2533 and submitting along with your personal tax return.

Meals include amounts spent for food beverages taxes and related tips. The annual exclusion applies to gifts to each donee. If you pay the entire cost of a health or accident insurance plan dont include any amounts you receive for your disability as income on your tax return.

If your church operates solely for religious and educational purposes your donation will qualify for the tax deduction. If you file taxes in more than one state each additional state is currently 12month. Refer to Tax Topic 423 Social Security and Equivalent Railroad Retirement Benefits for information about determining the taxable amount of your benefits.

If you e-file Form 4868 do not also send a paper Form 4868 unless you also mail a check or money order for your tax payment. You must to pay taxes on gifts you send if youve given more than 1158 million in your lifetime. E-file and pay by credit or debit card.

QUICKBOOKS DESKTOP PREMIER PLUS OFFER. A parent whos an alcoholic a. What ACEs do you have.

Most individuals use the cash method of accounting. There are 10 types of childhood trauma measured in the CDC-Kaiser Permanente Adverse Childhood Experiences Study. Do not count the days on which you commute to work in the United States from your residence in Canada or Mexico if you regularly commute from Canada or Mexico.

From a mobile device using the IRS2Go app. Be sure to mark the first date of the tax year as that of the year reflected in Form 1120S on line E. Five are related to other family members.

Terms conditions pricing special features and service and support options subject to change without notice. See Meals later for additional rules and limits. To help students and young Canadians who have been particularly hard-hit by COVID-19 we are waiving the interest for full-time and part-time students on the federal portion of Canada Student Loans and Canada Apprentice Loans until March 31 2023.

You may be able to view exempt organization. If you wish to make a payment by electronic funds withdrawal see the instructions for Form 4868. You will need to provide certain information from your tax return for 2020.

In most years as long as you itemize your deductions you can generally claim 100 percent of your church donations as a deduction. Waiving interest on student and apprentice loans. Be able to deduct contributions to certain Canadian charitable organizations covered under an income tax treaty with Canada.

This must be done no more than six months from the date on which the tax return is due.

Community And Non Profit Jobs In Canada Moving To Canada

Infographic On Charitable Giving In Canada From Imagine Canada Http Www Imaginecanada Ca Node 802 Infographic N Charitable Giving Infographic Charitable

Canadian Nonprofits Make Tax Receipts Compliant With Canada Revenue Agency S Regulations Nonprofit Blog

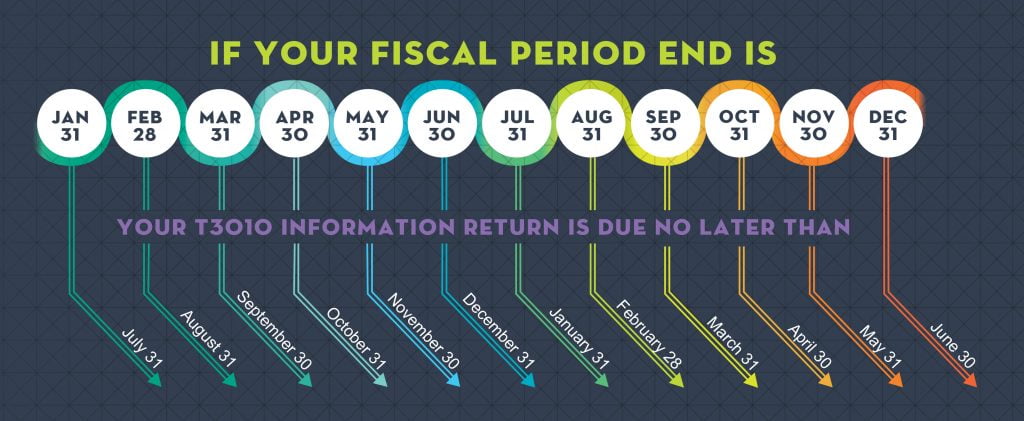

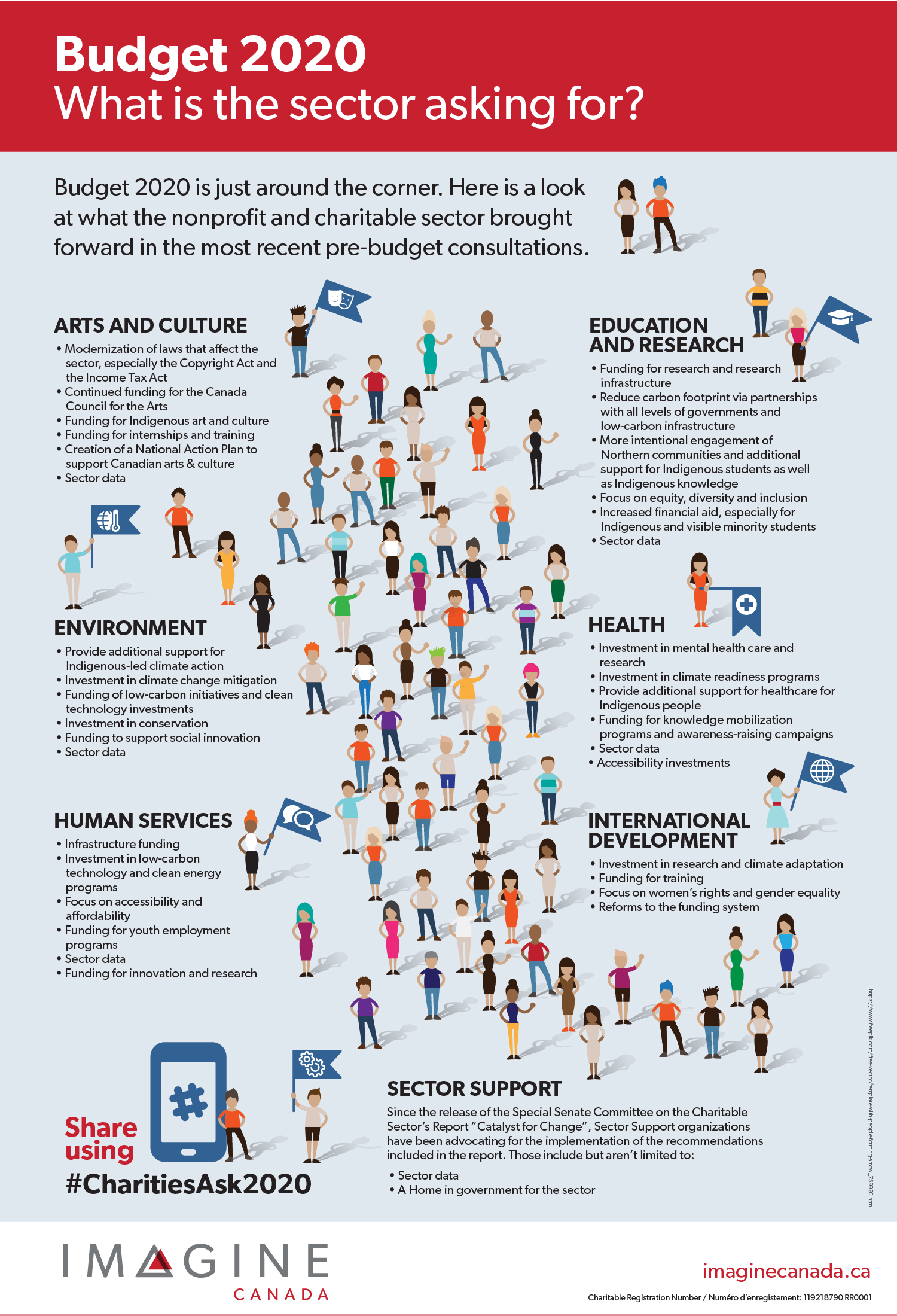

Budget 2020 What S The Sector Asking For Imagine Canada

Accounting And Bookkeeping For Non Profit Organizations Npo Green Quarter Consulting Surrey Bc

![]()

Guide To Gst Hst Information For Nonprofit Organizations Enkel

Non Profit Vs Not For Profit What S The Difference 2022

Simple Ways To Start A Nonprofit In Canada With Pictures

![]()

Canadian Tax Requirements For Nonprofits Charitable Organizations

Sources And Uses Of Incomes In The Nonprofit Sector

Rules Of Engagement The Nonprofit Vote

5 Steps To Running Payroll In Canada Payroll Payroll Template Canada Pension Plan

:max_bytes(150000):strip_icc()/not_for_profit_nonprofit_charity_AdobeStock_93906620-c07fd22b87c84bf28cf8b9caba9a1b67.jpeg)